| | | | Filed by the Registrantý⌧ |

Filed by a Party other than the Registranto◻ |

Check the appropriate box: |

ý⌧ |

|

Preliminary Proxy Statement |

o◻ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o◻ |

|

Definitive Proxy Statement |

o◻ |

|

Definitive Additional Materials |

o◻ |

|

Soliciting Material under §240.14a-12

|

| | | | | AbbVie Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý⌧ |

|

No fee required. |

o◻ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

(1) |

(1) |

|

Title of each class of securities to which transaction applies:

| | (2) | (2) | | Aggregate number of securities to which transaction applies:

| | (3) | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| | (4) | (4) | | Proposed maximum aggregate value of transaction:

| | (5) | (5) | | Total fee paid:

|

o◻ |

|

Fee paid previously with preliminary materials. |

o◻ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) |

(1) |

|

Amount Previously Paid:

| | (2) | (2) | | Form, Schedule or Registration Statement No.:

| | (3) | (3) | | Filing Party:

| | (4) | (4) | | Date Filed:

|

Notice of 2021

Annual Meeting

of Stockholders |

|

Important Notice Regarding the Availability of Proxy Materials for the Stockholder MeetingYou are cordially invited to Be Held on May 4, 2018

The Annual Meeting of the Stockholders of AbbVie Inc. will be held at the Fairmont Chicago, Millennium Park, 200 North Columbus Drive, Chicago, Illinois 60601, on Friday, May 4, 2018, at 9:00 a.m. CT for the following purposes:

•To elect four directors to hold office untilattend the 2021 Annual Meeting or until their successors are elected (Item 1),

•To ratify the appointment of Ernst & Young LLP as AbbVie's independent registered public accounting firm for 2018 (Item 2),

•To voteStockholders to be held on an advisory voteMay 7, 2021, where we will be voting on the approval of executive compensation (Item 3),

•To determine, in an advisory vote, whether the stockholder advisory votebelow matters. You will be able to approve executive compensation should occur every one, two or three years (Item 4),

•To vote on a management proposal regarding the annual election of directors (Item 5),

•To vote on a management proposal to eliminate supermajority voting (Item 6), and

•To transact such other business as may properly come before the meeting, including consideration of three stockholder proposals, if presented at the meeting (Items 7, 8, and 9).

Your Vote Is Important

Please promptly vote your shares by telephone, using the Internet, or by signing and returning your proxy in the enclosed envelope if you received a printed version of the proxy card.

The board of directors recommends that you vote FOR Items 1, 2, 3, 5, and 6 on the proxy card.

The board of directors recommends that you vote for an annual (1 YEAR) frequency of the stockholder advisory vote on executive compensation (Item 4).

The board of directors recommends that you vote AGAINST Items 7, 8, and 9 on the proxy card.

The close of business on March 7, 2018, has been fixed as the record date for determining the stockholders entitled to receive notice of and to vote atattend the Annual Meeting.Meeting, vote, and submit questions via live webcast by visiting www.virtualshareholdermeeting.com/ABBV2021.

AbbVie's 2018 Proxy Statement and 2017 Annual Report on Form 10-K are available at www.abbvieinvestor.com. If you are a registered stockholder, you may access your proxy card by either:

•Going to the following website:www.proxyvote.com, entering the information requested on your computer screen and following the simple instructions, or

•Calling (in the United States, U.S. territories, and Canada) toll free 1-800-690-6903 on a touch-tone telephone and following the simple instructions provided by the recorded message.

Admission to the meeting will be by admission card only. If you plan to attend, please complete and return the reservation form in the backItems of these materials and an admission card will be sent to you. Due to space limitations, reservation forms must be received before April 27, 2018. Each admission card, along with photo identification, admits one person. A stockholder may request two admission cards, but a guest must be accompanied by a stockholder.business

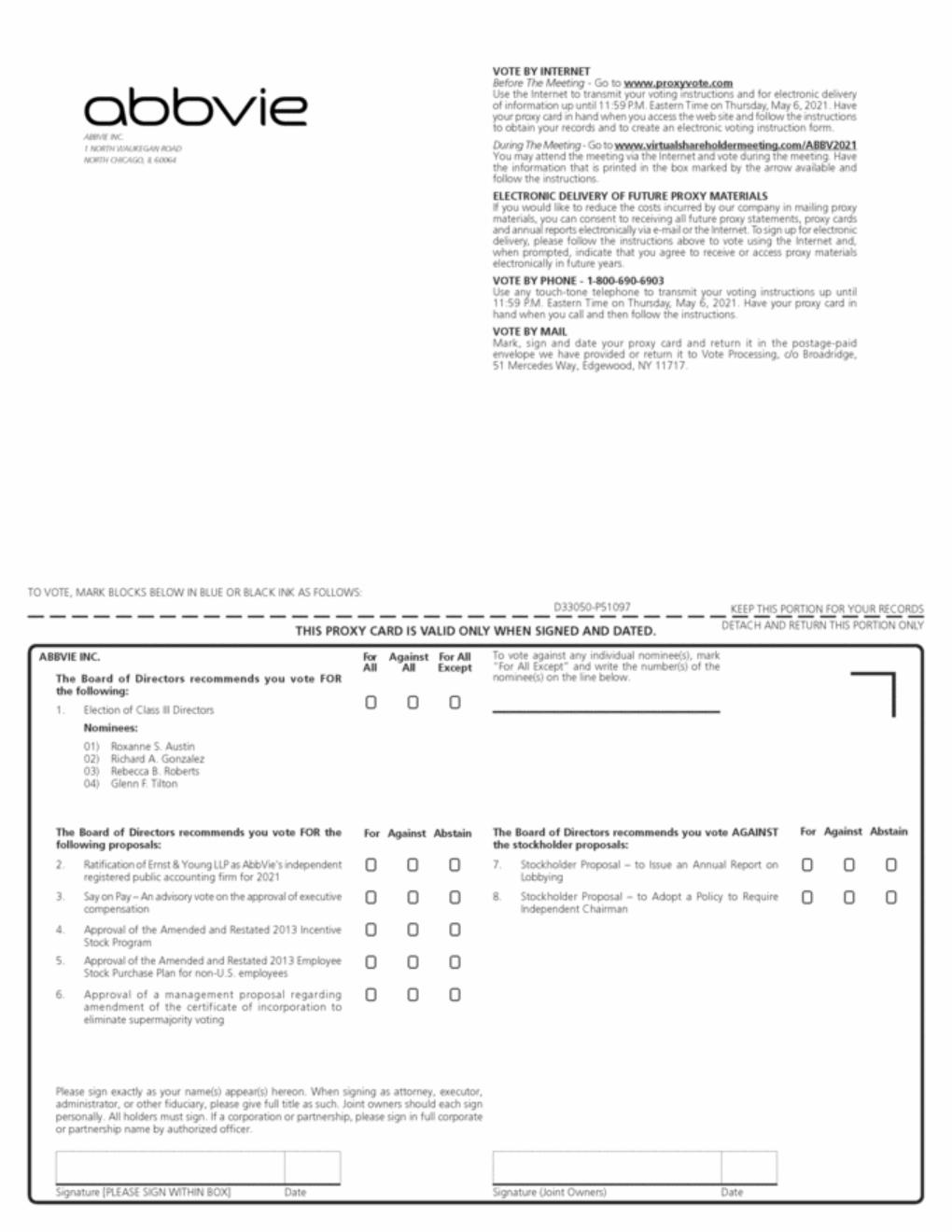

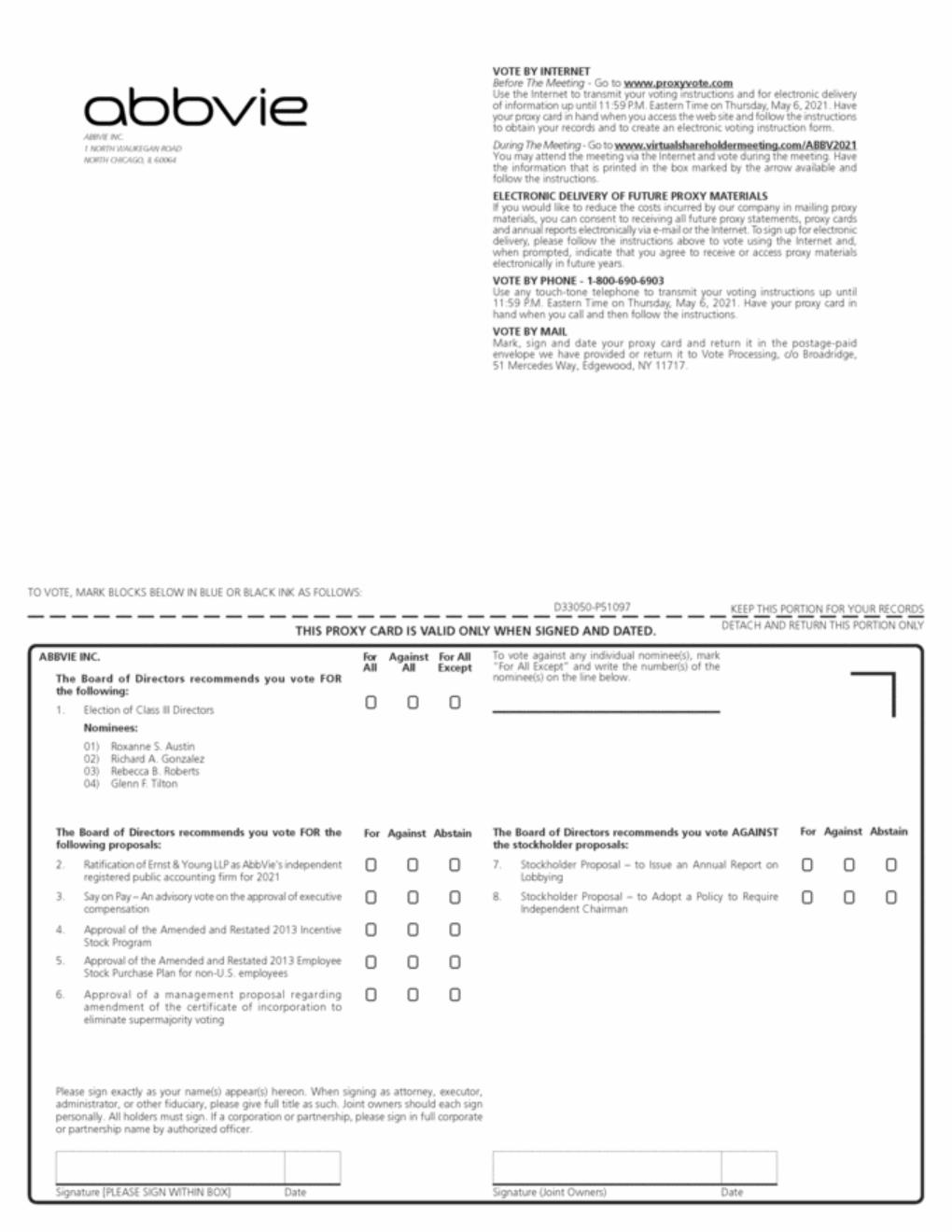

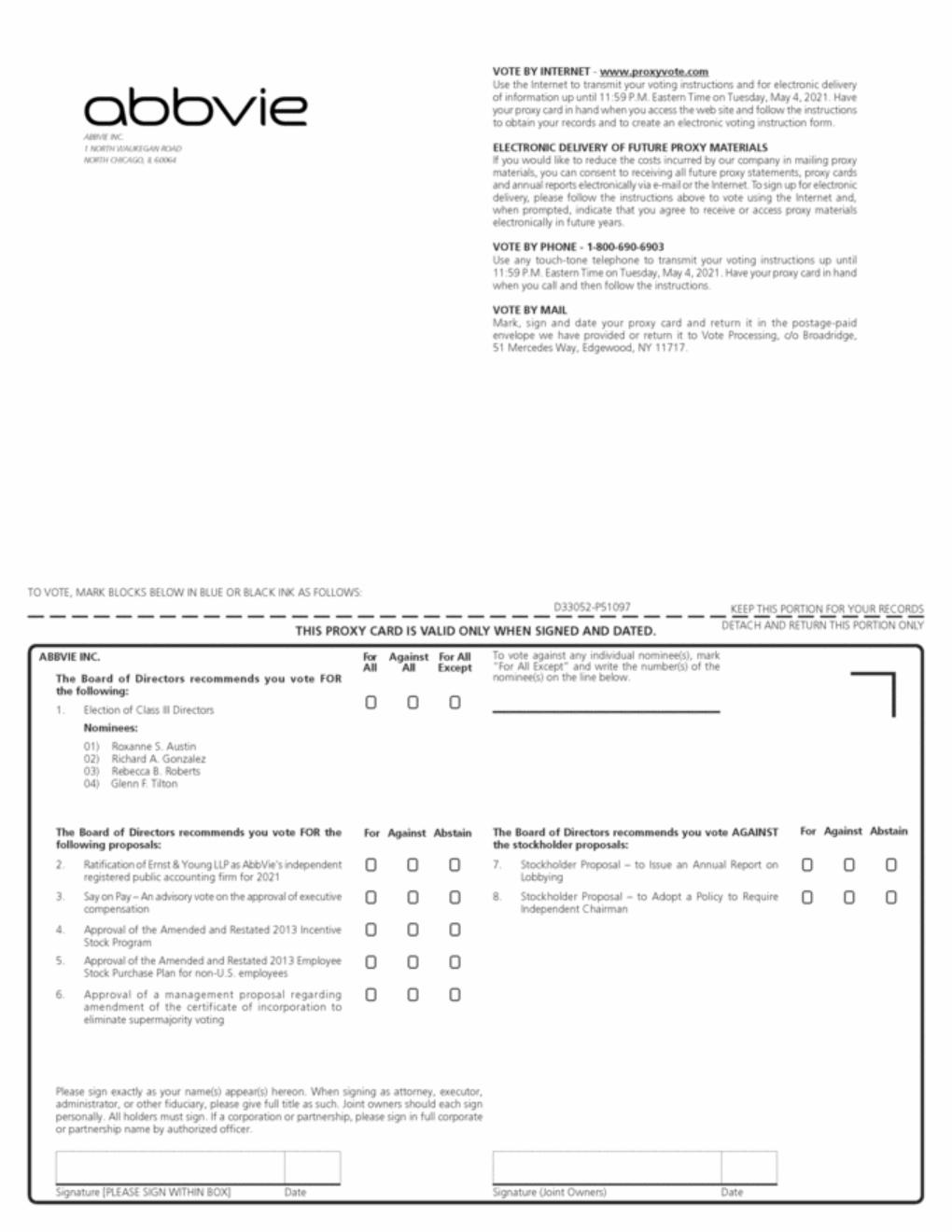

| ● | To elect four directors to hold office until the 2024 Annual Meeting or until their successors are elected. |

| ● | To ratify the appointment of Ernst & Young LLP as AbbVie’s independent registered public accounting firm for 2021. |

| ● | To vote on an advisory basis on the approval of executive compensation. |

| ● | To approve the amended and restated 2013 incentive stock program. |

| ● | To approve the amended and restated 2013 employee stock purchase plan for non-U.S. employees. |

| ● | To vote on a management proposal to eliminate supermajority voting. |

| ● | To consider any other matters that may properly come before the meeting, including two stockholder proposals, if presented during the meeting. |

| Your vote is important.

Please vote promptly using one of the methods mentioned below:

Internet

Visit www.proxyvote.com to vote online.

Mail

Sign and return your proxy card in the enclosed envelope if you received a printed version of the proxy card.

Telephone

Call toll-free 1-800-690-6903 in the U.S. and Canada.

At the virtual meeting

To be admitted to the virtual meeting, you must enter the control number found on your proxy card, voting instructions form, or notice you received. | | | The Annual Meeting of Stockholders of AbbVie Inc. (the “Annual Meeting”) will be held on Friday, May 7, 2021 at 9:00 a.m. CT. This year’s Annual Meeting will be a virtual meeting of stockholders. | | | |

|

|

| | | | DATE AND TIME: Friday, May 7, 2021

9:00 a.m. CT | WHERE: Via live webcast online at

www.virtualshareholdermeeting.com/ABBV2021. | ADMISSION: Stockholders of record at the close of business on March 8, 2021 are entitled to notice of and to vote at the annual meeting. | | | | Thank you for your continued support of and interest in the company. | | | | | By Order of the Board of Directors, | | | | | | | | | | Laura J. Schumacher | | | | | Secretary March XX, 2021 |

By order of the board of directors.

Laura J. Schumacher

Secretary

PROXY SUMMARY About the Meeting The accompanying proxy is solicited on behalf of the Board of Directors for use at the Annual Meeting of Stockholders. This summary highlights selected information in the proxy statement. Please review the entire proxy statement and the AbbVie 2020 Annual Report before voting. The voting items expected to be proposed at the meeting are listed below along with the board’s voting recommendations. | | 2021 Annual Meeting of Stockholders Information | | | Date and Time: Friday, May 7, 2021 at 9:00 a.m. CT | | | Place: Via live webcast online at www.virtualshareholdermeeting.com/ABBV2021 | | | Record Date: March 8, 2021 | | | | | | |

| | | | Proposal 1: Election of Directors | FOR

Each Nominee | Roxanne S. Austin

Richard A. Gonzalez | Rebecca B. Roberts

Glenn F. Tilton | | Each of the nominees has the skills and experience necessary to fulfill his or her oversight role with respect to AbbVie’s business and culture. See pages 14-20 for more information about the qualifications of our directors. |

| | Proposal 2: Ratification of Independent Auditor | FOR

| Ernst & Young LLP has served as our independent auditor since 2013. The board and the audit committee believe it is in the best interests of the company and its stockholders to retain Ernst & Young LLP as the company’s independent auditor. See page 67 for more information. | | | Proposal 3: Say on Pay—Pay – Advisory Vote on the Approval of Executive Compensation (Item 3) | | 62FOR

| Say When on Pay—Advisory Vote onAbbVie’s compensation program aligns executive interests with the Frequencydrivers of Future Approvals of Executive Compensation (Item 4)long-term, sustainable growth. Our program balances short- and long-term strategic objectives and directly links compensation to stockholder value. See pages 32-66 for more information.

| | 63 | Management Proposal Regarding the Annual Election of Directors (Item 5)

| | 64 | Proposal 4: To Approve the Amended and Restated 2013 Incentive Stock Program | FOR

| AbbVie is seeking approval to increase the number of shares available and extend the term of the program. See pages 71-81 for more information. | | | | Proposal 5: To Approve the Amended and Restated 2013 Employee Stock Purchase Plan for Non-U.S. Employees | FOR

| AbbVie is seeking approval to extend the term of the program. See pages 82-87 for more information. | | | | Proposal 6: Management Proposal to Eliminate Supermajority Voting (Item 6) | | 65FOR

| Stockholder ProposalsAbbVie is again seeking stockholder approval to eliminate supermajority voting thresholds in our charter and by-laws. See pages 88-89 for more information.

| | 66 | | | Stockholder Proposals | | | | Proposal 7: | Stockholder Proposal on Lobbying Report (Item 7) | | 66AGAINST | Stockholder Proposal to Separate Chair and CEO (Item 8)

| | 69 | | | Proposal 8: | Stockholder Proposal on Compensation Committee Drug Pricing Report (Item 9)Independent Chair | | 71AGAINST | Additional Information

| | 73 |

2021 Proxy Statement | 1 1

Table of Contents

The accompanying proxy is solicited on behalf of the board of directors for use at the Annual Meeting of Stockholders. The meeting will be held on May 4, 2018, at the Fairmont Chicago, Millennium Park, 200 North Columbus Drive, Chicago, Illinois 60601. This summary highlights selected information in the Proxy Statement. Please review the entire Proxy Statement and the AbbVie 2017 Annual Report before voting.

2018 Annual Meeting of Stockholders

| | PROXY SUMMARY | |

Date and Time: May 4, 2018 9:00 a.m. CT

Location: Fairmont Chicago, Millennium Park, 200 North Columbus Drive, Chicago, Illinois 60601Who We Are

Record Date: March 7, 2018

How to Vote:Stockholders as of the record date are entitled to vote via Internet atwww.proxyvote.com; by telephone at 1-800-690-6903; by returning a completed proxy card; or in person at the Annual Meeting of Stockholders.

| Voting Items and Board Recommendations

|

~ 47,000

employees worldwide | | | | |

| |

| | Board Recommendations

|

|---|

| | | | In more than 70 countries, AbbVie employees are working every day to advance health solutions for people around the world. | Item 1 | | Election | | Since becoming a public company in 2013, AbbVie’s mission has been to create an innovation-driven, patient focused biopharmaceutical company capable of Directors | | FOR All Nomineesachieving sustainable top-tier performance through outstanding execution and a consistent stream of new medicines. In 2020, AbbVie continued to advance its robust mid- and late-stage pipeline. Collectively, the new medicines that AbbVie has introduced since inception—including new therapies in rheumatoid arthritis, psoriasis, hematologic oncology and hepatitis C virus—represented approximately a quarter of AbbVie’s total sales in 2020 and will be important contributors in 2021 and beyond. AbbVie delivered another year of outstanding performance in 2020, which reflects the continued strength of its execution across business priorities.AbbVie’s products are focused on treating conditions such as chronic autoimmune diseases in rheumatology, gastroenterology, and dermatology; oncology, including blood cancers; virology, including hepatitis C virus and human immunodeficiency virus; neurological disorders, such as Parkinson’s disease; metabolic diseases, including thyroid disease and complications associated with cystic fibrosis; as well as other serious health conditions. AbbVie also has a pipeline of promising new medicines in clinical development across such important medical specialties as immunology, oncology, and neuroscience. In May 2020, AbbVie completed its acquisition of Allergan plc. Allergan is a global pharmaceutical leader focused on developing, manufacturing, and commercializing branded pharmaceutical, device, biologic, surgical, and regenerative medicine products for patients around the world. Allergan markets a portfolio of brands and products focused on key therapeutic areas such as aesthetics, eye care, neuroscience, women’s health, and gastroenterology. | Item 2 | | Ratification of Independent Auditor | | FOR | Item 3 | | Say on Pay—Advisory Vote on the Approval of Executive Compensation | | FOR | Item 4 |

Launched in

2013 | Say When on Pay—Advisory Vote on the Frequency of Future Approvals of Executive Compensation | | 1 YEAR | Item 5 | | Management Proposal Regarding the Annual Election of Directors | | FOR | Item 6 | | Management Proposal to Eliminate Supermajority Voting | | FOR | Item 7 |

Millions

of patient lives touched | Stockholder Proposal on Lobbying Report | | AGAINST | Item 8 | | Stockholder Proposal to Separate Chair and CEO | | AGAINST | Item 9 | | Stockholder Proposal on Compensation Committee Drug Pricing Report | | AGAINST |

Business Overview and Performance Highlights

|

| | | | | | | | | AbbVie’s Principles are foundational: | | Transforming Lives We inspire hope and transform lives every day. We make decisions based on our deep caring and compassion for people, delivering a lasting impact to our patients, their families, our employees and the community. |

| Acting with Integrity We strive to always do the right thing. With uncompromising integrity at the heart of everything we do, we pursue the highest standards in quality, compliance, safety and performance. |

| Driving Innovation

We innovate relentlessly in everything we do to tackle unmet needs. We invest in the discovery and development of new medicines and healthcare approaches for a healthier world. |

| Embracing Diversity & Inclusion We treat everyone equally, with dignity and respect. Around the world, our employees embrace diverse backgrounds and perspectives, which allows us all to achieve our best. |

| Serving the Community We are proud to serve and support the community and do our part to protect the environment. We make a remarkable impact that's felt within healthcare and beyond. |

2  Business Overview

| AbbVie was created in 2013 following separation from Abbott Laboratories. AbbVie's mission is to be an innovation-driven, patient-focused specialty biopharmaceutical company capable of delivering top-tier financial performance through outstanding execution and a consistent stream of innovative new medicines. AbbVie intends to continue to advance its mission in a number of ways, including: (i) growing revenues through continued strong performance from its existing portfolio of on-market products, including HUMIRA, IMBRUVICA and MAVYRET, as well as growth from pipeline products; (ii) continued investment in its pipeline in support of opportunities in immunology, oncology and neuroscience, as well as focused investments in other areas that augment AbbVie's core strengths; (iii) augmentation of its pipeline through concerted focus on strategic licensing, acquisition and partnering activity with a focus on identifying compelling programs that fit AbbVie's strategic criteria; and (iv) continuing to enhance efficiency by expanding operating margins; (v) returning cash to stockholders via dividends and share repurchases.

20182021 Proxy Statement| 1

Table of Contents AbbVie's products are focused on treating conditions such as chronic autoimmune diseases in rheumatology, gastroenterology and dermatology; oncology, including blood cancers; virology, including hepatitis C virus and human immunodeficiency virus; neurological disorders, such as Parkinson's disease; metabolic diseases, including thyroid disease and complications associated with cystic fibrosis; as well as other serious health conditions. AbbVie also has a pipeline of promising new medicines across such important medical specialties as immunology, oncology and neuroscience, with additional targeted investments in cystic fibrosis and women's health.

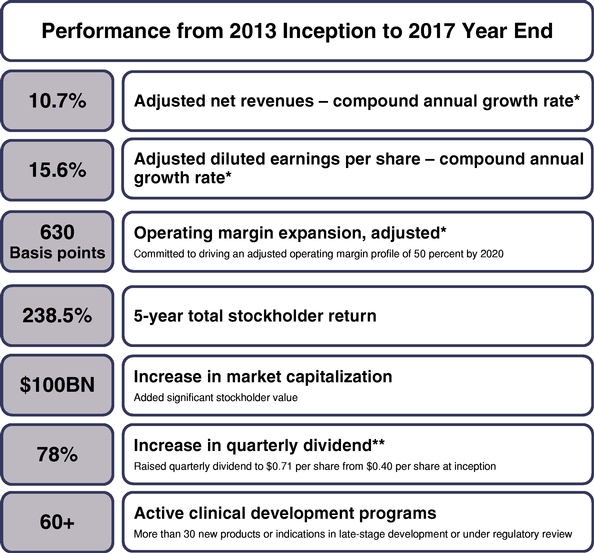

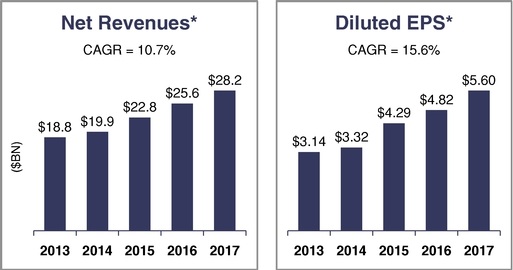

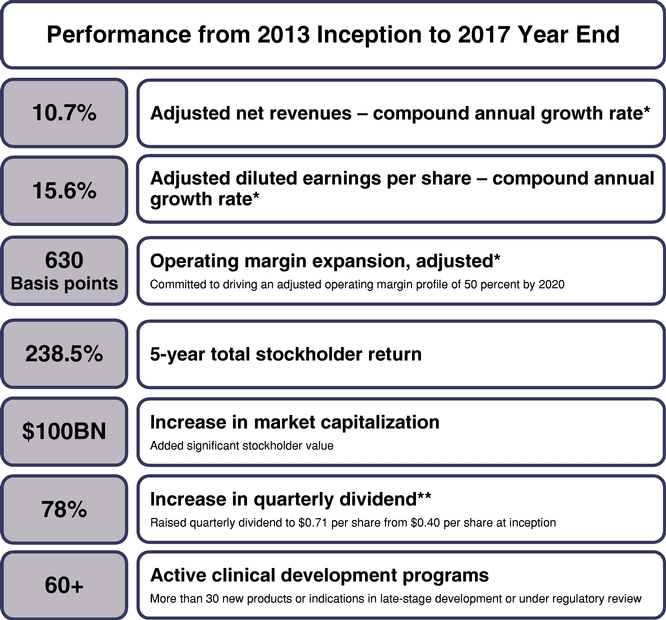

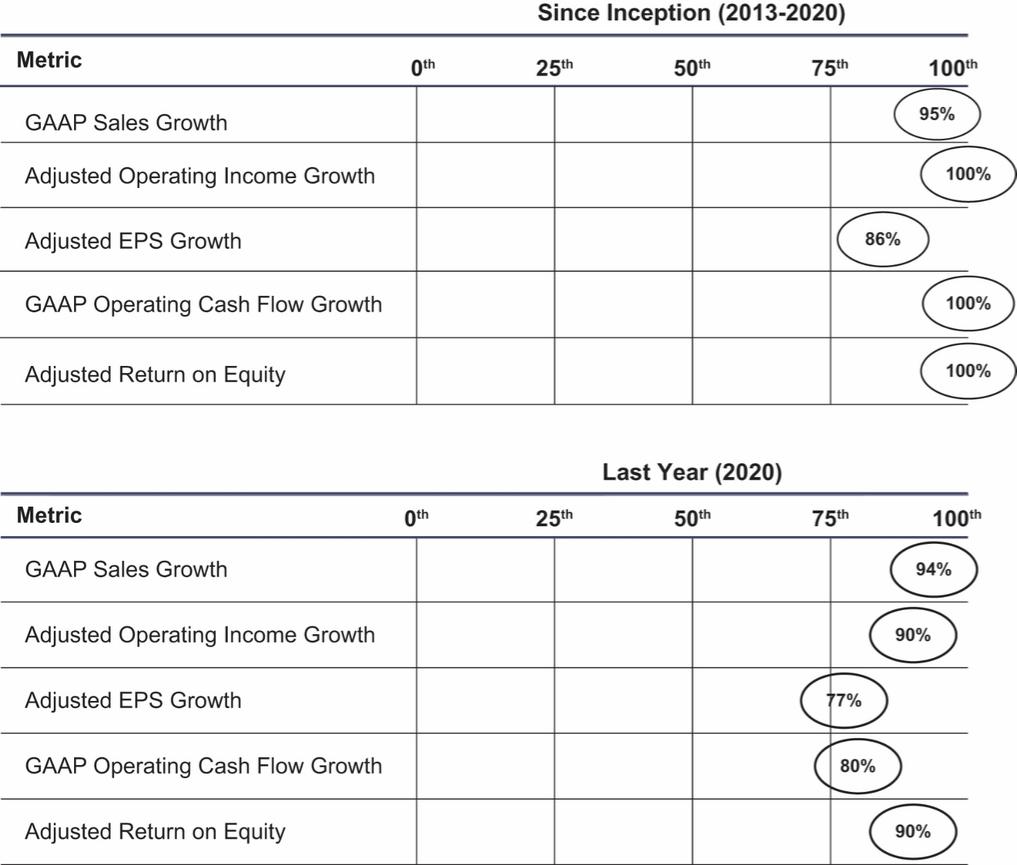

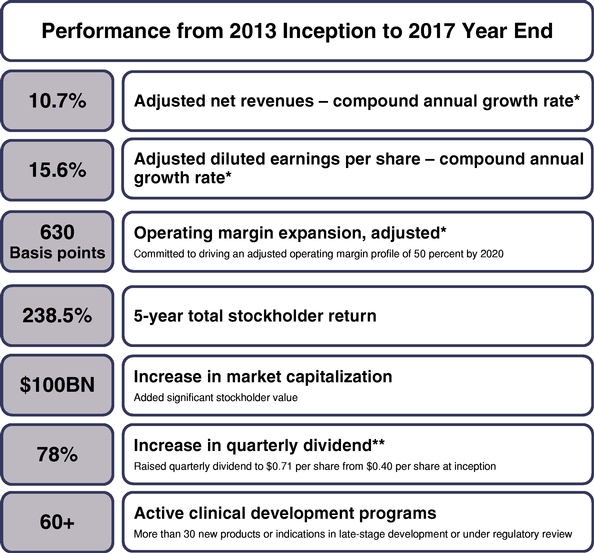

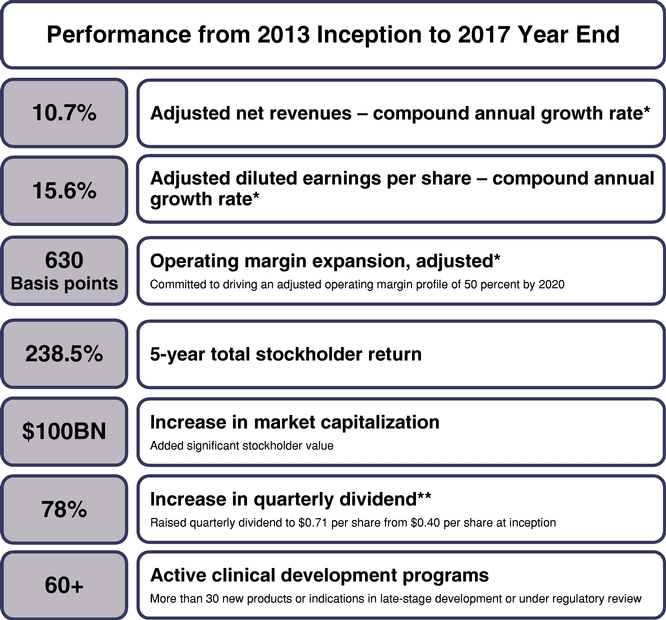

Our Business Performance Highlights

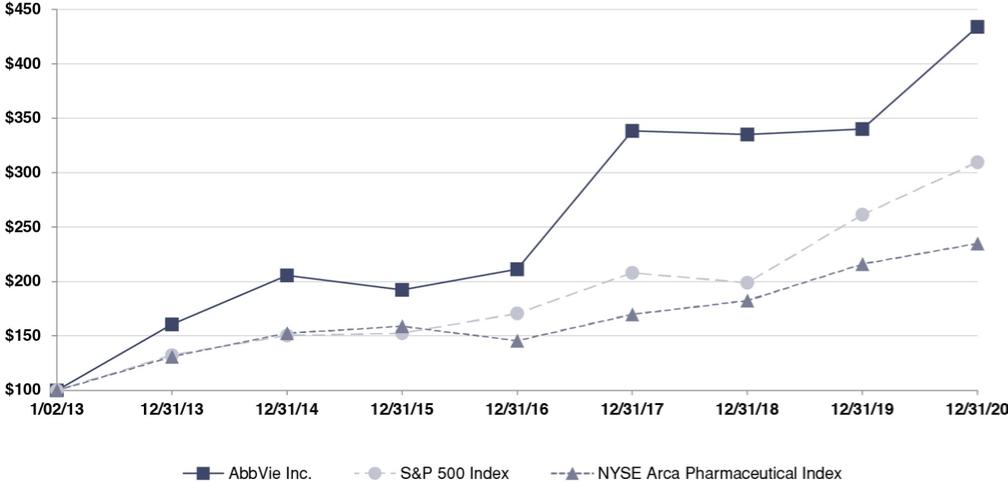

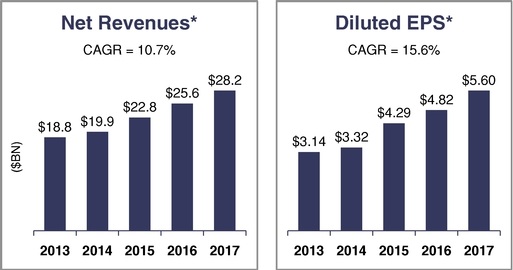

AbbVie has Delivered Robust Financial Resultsdelivered robust financial results since Separation

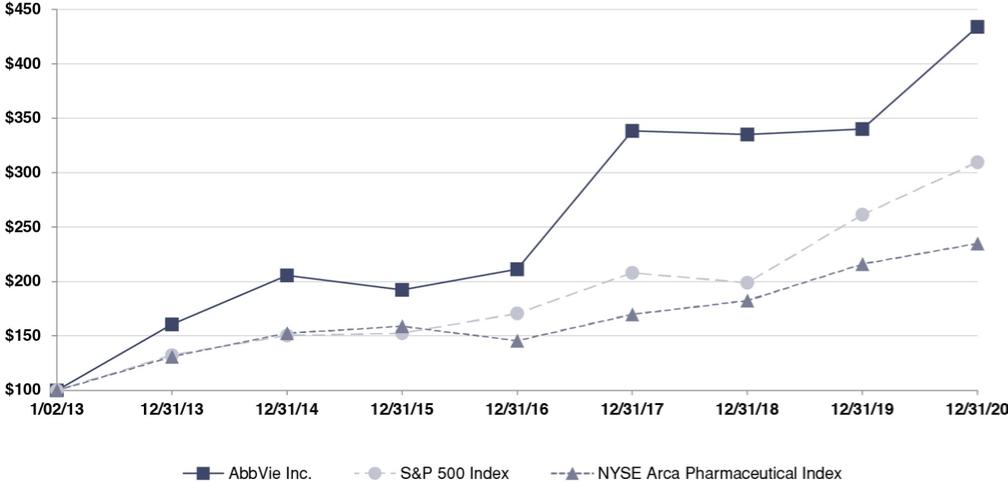

our launch in 2013 | | | | | | | | | 13.6% Adjusted net revenues - compound annual growth rate (CAGR)* | | | 334.1% 8 year total stockholder return | | | | | | | | | | ~$11BN Revenues in 2020 from products launched since inception (excludes Allergan portfolio) | | | ~$135BN Increase in market capitalization - added significant stockholder value | | | | | | | | | | 18.9% Adjusted diluted earnings per share - compound annual growth rate* | | | 225% Increase in quarterly dividend - raised quarterly dividend to $1.30 per share from $0.40 per share at inception | | | | | | | | | | 1,170 bps Operating margin expansion, adjusted* | | | 90+ Active clinical development programs - more than 50 compounds, devices, or indications in mid- and late-stage development |

The measures set forth above were calculated as of December 31, 2017.

2020. *Net revenues, diluted earnings per share, and operating margin are adjusted to exclude certain specified items and are non-GAAP measures, which are reconciled in Appendix B. | Adjusted Net Revenues* | | | | | Adjusted EPS* | |

| * | |

|

*Net revenues and diluted earnings per share are adjusted for specified items, including the impact of intangible asset amortization, and are non-GAAP measures, which are reconciled in Appendix B. 2021 Proxy Statement | 3 3

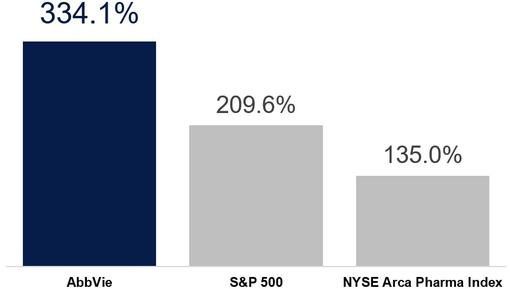

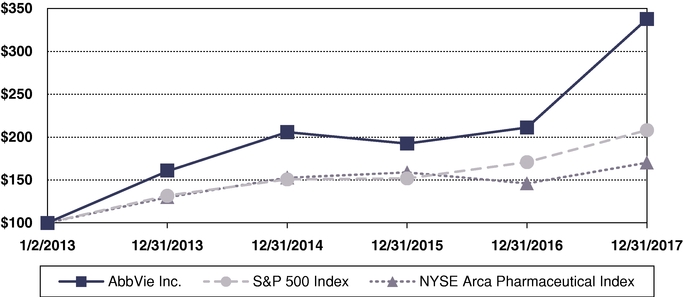

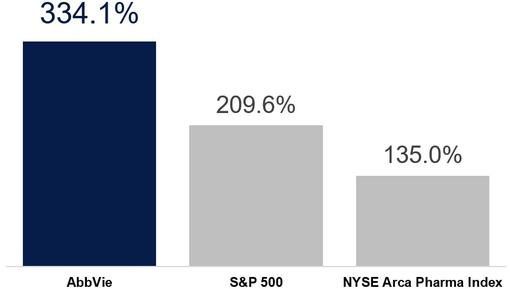

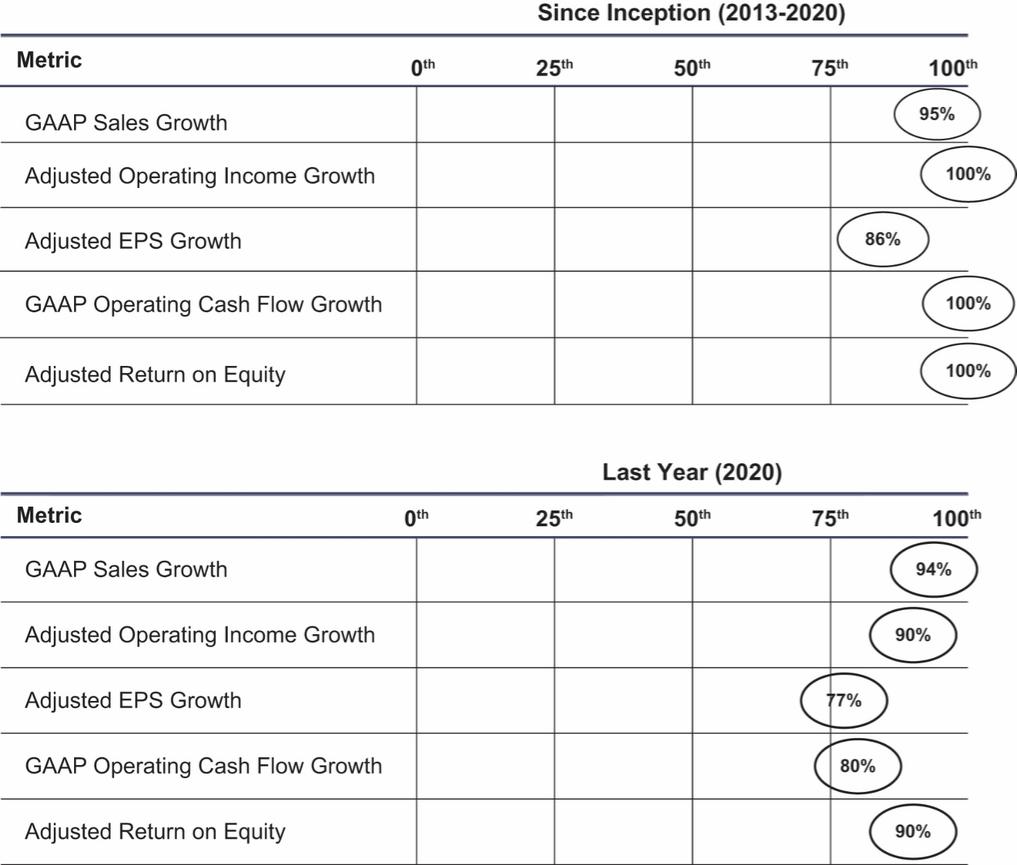

Since its launch in 2013, AbbVie has demonstrated an outstanding track record, consistently delivering top-tier results AbbVie has delivered a strong compound annual growth rate (CAGR) since inception on adjusted net revenues and adjusted diluted earnings per share (EPS), placing AbbVie in the top tier of its Health Care Peer Group. Additionally, AbbVie is committed to a robust return of capital to stockholders with an increase of 225% in its quarterly dividend since 2013 as part of a balanced and operating margin are adjusted to exclude certain specified itemsdisciplined capital allocation program. AbbVie’s total stockholder return (TSR) since inception of 334.1% also places AbbVie at the top of its Health Care Peer Group, and are non-GAAP measures, which are reconciled in Appendix C.more than 124 percentage points above the Standard & Poor’s 500 Index and more than 199 percentage points above the NYSE Arca Pharmaceutical Index over the same time period. | | Total stockholder return (TSR) since inception | | | ** | | In February 2018, AbbVie increased its quarterly cash dividend by an additional 35 percent from $0.71 per share to $0.96 per share payable May 15, 2018 to stockholders of record at the close of business on April 13, 2018. | |

|

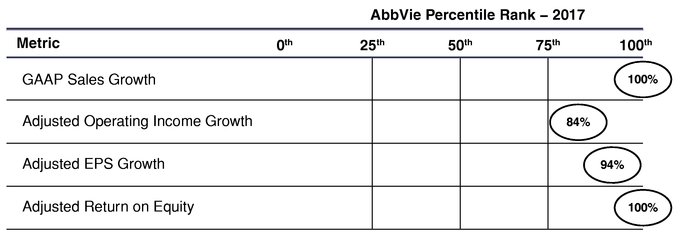

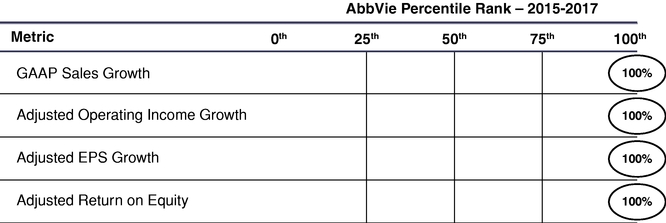

AbbVie has delivered a strong compound annual growth rate (CAGR) since inception on adjusted net revenues and adjusted diluted earnings per share (EPS), placing AbbVie in the top quartile of its Health Care Peer Group.

AbbVie Rankings vs. Peer Group | % Revenue Growth | | | % Adjusted EPS Growth | 2020 | | | 2020 | | | | | | | | | | | | | | | | | | | | | | | 2nd place out of 10 | | | 3rd place out of 10 | | | | | 3 Years | | | 3 Years | | | | | | | | | | | | | | | | | | | | | | | 2nd place out of 10 | | | 2nd place out of 10 | | | | | 5 Years | | | 5 Years | | | | | | | | | | | | | | | | | | | | | | | 2nd place out of 10 | | | 2nd place out of 10 | | | | | Total Stockholder Return | | | Our Peer Group | 2020 | | | AbbVie’s peer group above includes: Amgen, Inc. Bristol-Myers Squibb Company Eli Lilly and Company Gilead Sciences, Inc. GlaxoSmithKline plc Johnson & Johnson Merck & Company, Inc. Novartis AG Pfizer Inc. | | | | | | | | | | | | | | 2nd place out of 10 | | | | | | | | 3 Years | | | | | | | | | | | | | | | | | 5th place out of 10 | | | | | | | | 5 Years | | | | | | | | | | | | | | | | | 2nd place out of 10 | | | |

24   | |20182021 Proxy Statement

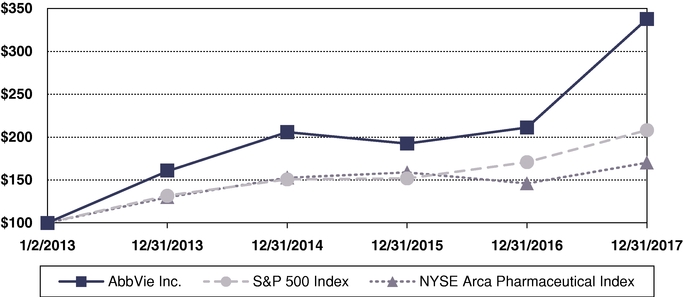

Table of Contents Additionally, AbbVie is committed to a robust return of capital to stockholders with an increase of 78% in its dividend since 2013 as part of a balanced and disciplined capital allocation program. In February 2018, AbbVie increased its dividend by an additional 35%, resulting in a total dividend increase of 140% since AbbVie became an independent company. AbbVie's total stockholder return (TSR) since inception of 238.5% also places AbbVie at the top of its Health Care Peer Group, and more than 130 percentage points above the Standard & Poor's 500 Index and more than 168 percentage points above the NYSE Arca Pharmaceutical Index over the same time period.

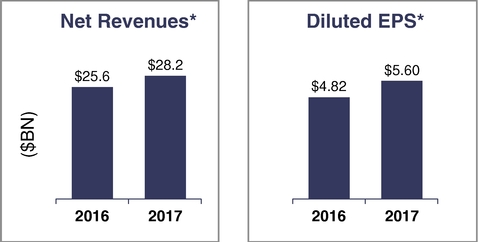

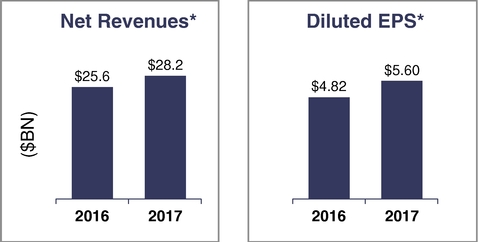

AbbVie has Significantly Grown Revenue and EPS Since 2013

| | | | | | | | | * | | Net revenues and diluted earnings per share are adjusted for specified items, including the impact of intangible asset amortization, and are non-GAAP measures, which are reconciled in Appendix C. | | PROXY SUMMARY |

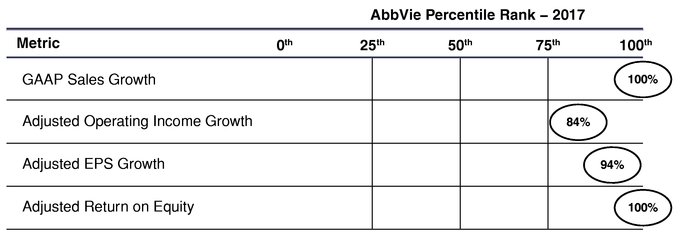

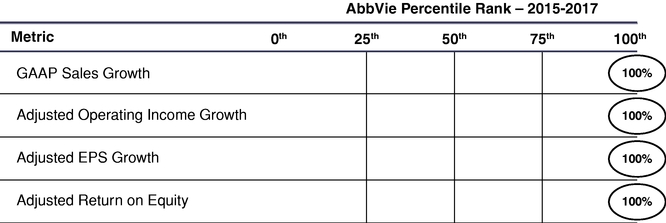

AbbVie has Delivered Outstanding Results, Ranking First or Second on Each of the Below Financial Metrics

also delivered strong business performance in 2020 | | | |

| Net Revenues: AbbVie reported worldwide net revenues of $45.8 billion in 2020. Worldwide net revenues increased by 38% on a reported basis and on a constant currency basis, which included $10.3 billion of contributed revenues from the Allergan acquisition, growth in the immunology portfolio from Skyrizi, Rinvoq and the continued strength of Humira in the U.S., as well as revenue growth from Imbruvica and Venclexta. Gross and Operating Margins: In 2020, AbbVie reported a gross margin of 66.4% on a GAAP basis or 82.1% of net revenues on an adjusted basis. AbbVie’s operating margin was 24.8% on a GAAP basis or 48.0% of net revenues on an adjusted basis. The adjusted operating margin reflects an improvement of 70 basis points versus 2019. Earnings Per Share: For 2020, AbbVie reported full-year diluted EPS of $2.72 on a GAAP basis and adjusted diluted EPS of $10.56, up 18.1%. For 2021, AbbVie provided a diluted EPS guidance range of $6.69 to $6.89 on a GAAP basis and $12.32 to $12.52 on an adjusted basis. The midpoint of the 2021 adjusted guidance represents growth of 17.6% over 2020, reflecting strong operating dynamics in the underlying business. Business Development: AbbVie acquired Allergan, creating a more diversified biopharmaceutical company positioned for success with a comprehensive product portfolio that has leadership positions in key therapeutic areas of immunology, hematologic oncology, aesthetics, neuroscience, eye care, and women's health. AbbVie also entered into collaboration agreements with Genmab to research, develop, and commercialize investigational bispecific antibody therapeutics for the treatment of cancer, as well as I-Mab Biopharma for the development and commercialization of lemzoparlimab for the treatment of multiple cancers. | |

| Regulatory Milestones: AbbVie also achieved a number of regulatory milestones in markets worldwide for several key products, including regulatory approvals for Imbruvica in combination with rituximab for the treatment of previously untreated patients with chronic lymphocytic leukemia (CLL) or small lymphocytic lymphoma (SLL), full approval of Venclexta in combination with azacitidine or decitabine or low-dose cytarabine in newly diagnosed acute myeloid leukemia (AML) patients ineligible for intensive chemotherapy, Oriahnn for the management of heavy menstrual bleeding due to uterine fibroids in pre-menopausal women, and Juvederm Voluma XC for the augmentation of the chin region to improve the chin profile in adults over the age of 21. AbbVie also submitted regulatory applications for Rinvoq in three additional indications: the treatment of adult patients with active psoriatic arthritis (PsA), for the treatment of adult patients with active ankylosing spondylitis (AS), and for the treatment of adults and adolescents with moderate to severe atopic dermatitis (AD). | |

| Pipeline Development: With more than 50 programs in mid- and late-stage development, AbbVie made significant pipeline advancements in 2020. The company initiated several important Phase 3 programs including studies for Skyrizi in ulcerative colitis, Venclexta in myelodysplatic syndrome (MDS), and navitoclax in myelofibrosis. AbbVie also reported positive data from Phase 3 studies in other areas of the pipeline, including atogepant for migraine prevention and AGN-190584, an investigational ophthalmic solution, for the treatment of presbyopia. |

(1)AbbVie's peer group above includes: Amgen, Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Gilead Sciences, Inc., GlaxoSmithKline plc, Johnson & Johnson, Merck & Company, Inc., Novartis AG and Pfizer Inc.

(2)A 5-year adjusted EPS comparison is not available because AbbVie did not report adjusted EPS in 2012 as it did not become an independent company until January 2013.

20182021 Proxy Statement |  3 5

Table of Contents AbbVie also Delivered Strong Business Performance in 2017

AbbVie has built a strong foundation for its business and 2017 was an exceptional year, as evidenced by a number of business highlights:

•Net Revenues: AbbVie reported full-year net revenues of $28.2 billion on a GAAP and adjusted basis, an increase of 10.1% over 2016, excluding the impact of foreign exchange. This reflects growth in the top-tier of AbbVie's Health Care Peer Group.

•HUMIRA: AbbVie delivered global HUMIRA sales of $18.4 billion, an increase of 14.6% on a reported basis, or 14.4% excluding the impact of foreign exchange. HUMIRA's performance was driven by continued biologic penetration across therapeutic categories and geographies.

•IMBRUVICA: Global IMBRUVICA net revenue was $2.6 billion, an increase of 40.5%, driven by market share growth in front-line chronic lymphocytic leukemia (CLL) and other approved indications.

•Gross and Operating Margins: In 2017, AbbVie reported a gross margin of 75.1% on a GAAP basis or 80.5% of net revenues on an adjusted basis. AbbVie's operating margin was 34.0% on a GAAP basis or 42.6% of net revenues on an adjusted basis.

•Earnings Per Share: AbbVie reported full-year diluted EPS of $3.30 on a GAAP basis and adjusted diluted EPS of $5.60, up 16.2%. This reflects growth in the very top-tier of AbbVie's Health Care Peer Group. For 2018, AbbVie provided a diluted EPS guidance range of $6.45 to $6.55 on a GAAP basis and $7.33 to $7.43 on an adjusted basis. The midpoint of the adjusted guidance represents growth of 32% over 2017, reflecting strong operating dynamics in the underlying business and the enactment of the Tax Cuts and Jobs Act.

•Regulatory Milestones: AbbVie also achieved a number of regulatory milestones in markets worldwide for several key products, including regulatory approvals for MAVYRET, the company's pan-genotypic treatment for HCV, as well as two new indications for IMBRUVICA in relapsed/refractory marginal zone lymphoma and second-line chronic graft-versus-host disease.

•Pipeline Development: With a record number of programs in mid- and late-stage development, AbbVie made significant pipeline advancements in 2017. AbbVie announced data from a dozen pivotal trials, initiated a number of important phase transitions across our key development programs and made multiple regulatory submissions. AbbVie reported positive results from several registrational trials for the company's next-generation immunology assets, upadacitinib and risankizumab, in RA and psoriasis, respectively. Based on strong mid-stage data, the company decided to advance these assets into Phase 3 development for a number of follow-on indications, including Crohn's disease, psoriatic arthritis and atopic dermatitis. Results from the Phase 3 MURANO trial showed a profound improvement in progression-free survival in patients treated with combination treatment of VENCLEXTA and Rituxan compared to a standard regimen. As a result, a regulatory application was submitted for VENCLEXTA for relapsed/refractory chronic lymphocytic leukemia. A regulatory application also was submitted for elagolix for endometriosis-associated pain. Both VENCLEXTA and elagolix received priority review designations from the FDA.

Corporate Governance HighlightsPROXY SUMMARY

| |

Our Governance Highlights Our board of directors is committed to strong corporate governance tailored to meet the needs of AbbVie and its stockholders to enhance long-term stockholder value. Each year, AbbVie completes a robust investor engagement program with governance investment teams. In connection2020, we reached out to stockholders representing over 40% of our outstanding shares. Our engagements in 2020 generally focused on (1) the impact of COVID on our business and how the company is supporting our employees, (2) the Allergan acquisition and integration, including the culture of the combined company, (3) AbbVie’s equity, equality, diversity, and inclusion programs and disclosures, (4) AbbVie’s executive compensation programs, and (5) AbbVie’s board composition and leadership structure, including the responsibilities of our lead independent director. The board reviews feedback from these engagements and discusses opportunities to improve AbbVie’s governance practices. The following chart summarizes some of the governance practices that the board has adopted over the past several years as a result of dialogue with our ongoing, proactive engagement with stockholders (as described in greater detail on page 32), AbbVie's board of directors:stockholders: • | | | | Topic: | Actions taken by our board: | | Stockholder

Voting Rights | approved a management proposal to eliminate supermajority votingin this proxy statement (Item 6) to seek stockholder approval to amend the company’s Amended and Restated Certificate of Incorporation to provide for a simple majority of shares outstanding for all provisions previously subject to a supermajority provision, as described in Item 6 and previously submitted the same proposal to stockholder vote in 2020, 2019, and 2018 as well as a declassification management proposal to a stockholder vote in 2018, 2017, and 2016 | | Proxy Access | approved and implemented in 2016 a proxy access by-law provision, as further detailed in the company’s By-Laws | | Lead Independent Director Role | significantly expanded disclosure on the lead independent director responsibilities in the 2019 and 2018 proxy statements, to better inform our stockholders on the robust leadership that the role provides changed the election criteria for the lead independent director, so that the lead independent director can be elected from all of AbbVie’s independent directors, instead of the role being linked to the chair of the nominations and governance committee appointed the lead independent director to all committees in 2019, further strengthening his active leadership role | | Board Skills Disclosure | shared our board skills matrix beginning in 2016, which contains the skills considered by the nominations and governance committee to be the most relevant to the board’s oversight role with respect to AbbVie’s business and affairs and to drive our culture of innovation and responsibility | | Environmental, Social, and Governance (ESG) Disclosures | disclosed detailed data on the diversity of AbbVie’s U.S. workforce by publishing AbbVie’s EEO-1 report on our website in 2020 incorporated an overview of AbbVie’s corporate responsibility approach and initiatives in the proxy statement beginning in 2018 expanded the description of AbbVie’s clawback policy,starting in the 2019 proxy statement added board diversity data, starting in the 2019 proxy statement, along with an expanded discussion of the value of director diversity in this proxy statement |

6 in this proxy statement (Item 6) to seek stockholder approval to amend the company's Amended and Restated Certificate of Incorporation to 4   | |20182021 Proxy Statement

Highlights of our governance practices include:

Additional highlights of our governance practices include: | | | | | | Director independence Governance Practice✓

| | For more information

|

|---|

| | | Independent lead director with robust responsibilities is selected by the board | | p. 15 | Nine Eleven of AbbVie's tenAbbVie’s twelve directors areindependent and regularly meet inexecutive session✓ | | p. 15 | | Since our inception, we have had a lead independent director with robust responsibilities ✓All members of theour audit, compensation, nominationsnomination and governance, and public policycommittees are independent | | p. 18 | Stockholder rights ✓Adopted a proxy access By-Law provision for 3%/3 years ✓ | | p. 75 | Policyprohibiting hedging and pledging | | p. 41 | Robuststock ownership guidelines | | p. 40 | Disclosure of our corporatepolitical contributions and ourtrade association dues and oversight process | | http://www.abbvie.com/responsibility/transparency-policies/corporate-political-participation.html | Clawback authority in the event of financial restatement to recover incentive plan awards | | p. 41 | For inclusion on the board, the nominations and governance committee considersdiversity of ethnicity, gender, and geography | | p. 16 | Related person transaction policy to ensure appropriate oversight | | p. 73 | We do not have astockholder rights plan or "poison pill"“poison pill”✓ | | Certificate of Incorporation and By-Laws | | Our directors are elected by amajority vote of our stockholders for uncontested elections, and we have a resignation policy if the director fails to receive a majority of the votes cast | | p. 10 | Board and executive accountability ✓Annual executive succession planning, including an assessment of the diversity of executive candidates ✓ Minimum stock ownership guidelines are in place for the CEO and other NEOs ✓ We have a related person transaction policy to ensure appropriate oversight ✓We hold anannual say-on-pay advisory vote on executive compensation | | p. 62 | | | | | | | | | | | Board composition and effectiveness ✓Our governance guidelines restrict the number of boards our directors may serve on toprevent overboarding ✓ | | Corporate Governance Guidelines | | Annual board and committeeself-assessments and annual board succession planning ✓ For inclusion on the board, the nominations and governance committee considers diversity of race, ethnicity, gender, and geography, together with other voluntarily identified diversity criteria | | Corporate Governance GuidelinesClawback and anti-hedging and anti-pledging policies ✓ The Board has broad authority to recover incentive plan awards ✓ Directors and executive officers are prohibited from buying or selling any financial instruments designed to hedge or offset any decrease in the market value of AbbVie equity securities they hold ✓ Directors and executive officers are prohibited from pledging AbbVie stock as collateral for a loan | | Other ESG practices ✓ All executives have performance goals related to protecting the reputation and driving the sustainability of the company ✓We are guided by strongethics programs andsupplier guidelines | | http://www.abbvie.com/responsibility/home.html |

Corporate Responsibility Highlights✓ We disclose our corporate political contributions, our trade association memberships, and oversight process on our website

|

We are passionate about our work to improve lives and go about it in a sustainable and responsible way. AbbVie has strong commitments and a comprehensive approach to corporate responsibility focused on: (i) improving health outcomes, particularly in areas of unmet need, and enhancing access to healthcare across geographies, (ii) operating responsibly and cultivating an ethical, transparent and inclusive culture to drive sustainable growth, and (iii) contributing to communities and addressing challenges of the underserved. The board of directors and public policy

20182021 Proxy Statement |  5 7

Table of Contents committee overseeOur Corporate Responsibility 2020 Highlights

Acting responsibly is ingrained in everything we do and is how we drive a long-term, sustainable business that makes a genuine and lasting positive impact for patients, employees, and communities. During 2020, our corporate responsibility efforts including how thesefocused on three key areas: | | | | | | | | | | | | | | | | 1 | Using our expertise and resources to contribute to the fight against COVID-19 | | 2 | Driving meaningful change within AbbVie and our broader communities on equity, equality, diversity, and inclusion, as well as racial justice | | 3 | Proactively addressing other environmental, social, and governance (ESG) topics material to AbbVie |

| | | | | Contributing to the fight against COVID-19 |

From the early days of the pandemic, AbbVie quickly marshalled our resources and expertise to help contribute to the fight against COVID-19 in four main areas: | ● | Protecting our employees’ well-being |

| o | The health and safety of our employees remains a key priority for AbbVie during the pandemic. In order to protect our employees, we implemented, among other things, temporary office and facility closures and establishment of new safety and cleaning protocols; regular communication regarding the effect of the pandemic on our business and employees; establishment of physical distancing procedures, modification of workspaces, and provision of personal protective equipment for employees; temperature screening at all of our locations; a variety of testing resources including on-site and at-home testing; and remote working accommodations. |

| o | We also provided paid leave and other support and accommodations to our employees with relevant medical, pharmaceutical, R&D, science, and public health experience who desired or were requested to serve as volunteers during the pandemic. |

| o | We recognize the challenges working professionals are facing, especially those who are parents. In addition to existing employee assistance programs, we created new resources, such as a COVID-19 Childcare Relief Fund to support eligible employees to help with childcare or remote learning expenses. |

| o | Lastly, AbbVie’s commitment to employees included no workforce reductions or salary reductions due to COVID-19. |

| ● | Using our experience as a research-based biopharmaceutical company |

| o | In response to the growing public health crisis, AbbVie has partnered with global authorities to support the experimental use of multiple AbbVie assets to determine their efficacy in the treatment of COVID-19. |

| o | Our R&D team reviewed our compounds, existing medicines, and pipeline assets to evaluate their efficacy as potential treatments while simultaneously building and accelerating discovery efforts for COVID-19 treatments. We also launched a Phase 2 study of ibrutinib as a potential treatment for COVID-19. |

| o | We have participated in numerous external collaborations, such as the Accelerating COVID-19 Therapeutic Interventions and Vaccines (ACTIV) partnership led by the National Institutes of Health and the Foundation for the NIH (FNIH), in order to help accelerate research on COVID-19 medicines. |

| o | Given the need to significantly increase access to testing, in 2020 we began using our laboratory expertise to work with health authorities locally and globally to create a clinical COVID testing |

8  |2021 Proxy Statement |2021 Proxy Statement

| | capability. We have also used our capabilities to manufacture viral transport medium, which is necessary to preserve swabs prior to lab testing. |

| ● | Giving back to communities through product donations, PPE donations, and financial support |

| o | In 2020, AbbVie donated $35 million to help support underserved communities and health care systems working to address the impact of the COVID-19 global pandemic. This funding has led to, among other things, the creation and operation of 26 mobile field hospitals across the U.S., distribution of millions of units of personal protective equipment, distribution of equipment and supplies in the hardest-hit European countries (including oxygen concentrators, ventilators and personal protective equipment), and protection for the most vulnerable, including the elderly, by enabling access to food and essential household supplies with minimal contact. |

| o | We donated over 100,000 units of our HIV medicine Kaletra/Aluvia (lopinavir/ritonavir) globally as an experimental option for the treatment of COVID-19 during the early part of the pandemic. We also donated approximately 50,000 units of Nimbex, which is administered to intubated patients, to the U.S. government. |

| o | We donated over 350,000 surgical and N95 masks to various hospital systems across major locations where AbbVie operates. Additionally, AbbVie manufactured hand sanitizer and donated pallets of excess personal protective equipment, including gowns, gloves and hair covers, to various institutions, including health departments, jails, long term care facilities, medical centers and veterans’ organizations in Illinois and the Bay Area. |

| o | To support the Illinois Department of Public Health, we donated approximately 280,000 units of viral transport media. |

| ● | Ensuring continuity of supply and access for AbbVie’s patients |

| o | In the initial weeks of the pandemic, AbbVie made a global decision to give up all patent rights to Kaletra/Aluvia. The pandemic caused unprecedented demand for Kaletra/Aluvia, which was widely tested as a potential COVID-19 treatment. Releasing our patent rights allowed other companies to manufacture Kaletra/Aluvia, helping to meet this unprecedented demand. |

| o | As assurance of treatment supply for our patients has been our most critical priority during COVID-19, AbbVie’s Manufacturing, Purchasing and Supply Chain readied its network to ensure we pre-purchased our key materials to maintain zero back orders in 2020 and build enough inventory to support our 2021 demand. |

| o | Through our U.S. patient assistance program, myAbbVieAssist, and the Allergan Patient Assistance Program, we help patients who may be having trouble paying for their AbbVie medicine. In 2020, more than 153,000 patients received their AbbVie medicines from our programs at no cost. Starting in March 2020, we leveraged national television, newspaper, and digital advertisements to raise awareness about our patient assistance programs to help people affected by the pandemic continue to receive their AbbVie medicine. |

Driving meaningful change on EED&I and racial justice |

| | During 2020, AbbVie intensified its efforts to drive meaningful change on equity, equality, diversity, and inclusion (EED&I), as well as racial justice. These efforts included internal initiatives at the company and significant external philanthropic initiatives to support underserved Black communities across the United States. | “The private sector has a responsibility to help address racial inequity issues plaguing our nation. We believe investing in this important work – in partnership with national and local nonprofits – will create immediate opportunities and advance meaningful and lasting change.” – Richard A. Gonzalez, Chairman and CEO, AbbVie |

| ● | A cornerstone of AbbVie’s human capital management approach is to value and take into account the backgrounds and perspectives of our diverse workforce. In 2019, we adopted a five-year Equity, Equality, Diversity & Inclusion (EED&I) roadmap that defines key global focus areas, objectives and associated initiatives, and includes implementation plans organized by business function and geography. AbbVie’s senior leaders have adopted formal goals aligned with executing this strategy. |

2021 Proxy Statement | 9 9

| ● | In 2020, AbbVie appointed two additional senior level positions, including our Chief Equity Officer, to drive change and awareness company-wide and take deliberate steps to ensure we lead by example in promoting racial equity. |

| ● | An important part of our strategy is to instill an inclusive mindset in all leaders and employees, so we can realize the full value of our diverse workforce. In 2020, we increased education resources across the company by launching our virtual Impact through Inclusion Learning Series comprised of two awareness sessions: Stand by Me, completed by more than 18,000 employees and Talking Race, completed by more than 5,000 people leaders. More than 6,000 employees globally completed AbbVie’s Inclusive Culture Learning Series as well. |

| ● | With a focus on nurturing an inclusive culture, our Employee Resource Groups (ERGs) created connections and community, hosted awareness events, and provided leadership and career opportunities. In 2020, we increased membership across every Employee Resource Group, 53% overall and 165% outside the United States. |

| ● | We made a donation of $5 million to NAACP Legal Defense and Education Fund and the Equal Justice Initiative to address issues in our criminal justice system and made an additional commitment of $50 million in a five-year program to support underserved Black communities across the United States. On December 9, 2020, we announced the nonprofit partners for the $50 million investment. AbbVie will collaborate with these partners to bring lasting and real change at the community level by 1) promoting health equity for Black Americans and other historically underserved populations, 2) fostering workforce development opportunities for Black Americans, and 3) expanding educational opportunities for historically underserved youth and young adults. In addition, we expanded our employee matching program to $3-to-$1 for donations to civil rights nonprofits fostering racial equity. |

| ● | Allergan Aesthetics, an AbbVie company, and Skinbetter Science® announced the launch of a new long-term, educational initiative – DREAM: Driving Racial Equity in Aesthetic Medicine™. The DREAM Initiative™ is committed to furthering the principles of racial and ethnic diversity, inclusion, respect and understanding in the fields of dermatology and plastic surgery. |

| | | | | Proactively addressing environmental, social, and governance priorities |

At AbbVie, we know that in order to be successful over the long-term, we need to proactively address environmental, social, and governance topics that are incorporated into our business strategy.material to the company, including: Recent examples

| ● | Delivering innovative medicines that offer significant health benefit |

| o | At AbbVie, we strive to make a remarkable impact on patients and drive sustainable growth by discovering and delivering a consistent stream of innovative medicines that address serious health problems. In order to drive the long-term sustainability of our business we will continue to make responsible pricing decisions for these medicines, and this is reflected in our long-range plan. Our growth is primarily driven by reaching more patients with innovative new medicines, not increases in price. |

| o | In 2020, AbbVie achieved 12 new product or indication approvals or expansions. These included treatments for rheumatoid arthritis, moderate to severe plaque psoriasis, and previously untreated chronic lymphocytic leukemia. |

| o | ABBV-4083, an investigational compound that AbbVie is co-developing on a pro-bono basis, has been shown to be safe in a Phase 1 study in healthy volunteers. Preparations to start a Phase 2 study in patients with river blindness in the Democratic Republic of the Congo included renovating a clinic and training medical staff in a remote area. The study, which will start in early 2021, will be conducted by our partner, Drugs for Neglected Diseases initiative, with drug product and pro-bono technical support from AbbVie. |

| o | AbbVie announced that the FDA granted Orphan Drug and Fast Track designation for elezanumab (ABT-555), an investigational treatment for patients following spinal cord injury. Elezanumab is currently in phase 2 studies for the treatment of spinal cord injuries, multiple sclerosis, and acute ischemic stroke. |

| ● | Advancing our environmental sustainability |

| o | We continued progress on our environmental sustainability strategy focused on reducing our environmental footprint, growing sustainably and inspiring, educating and engaging our workforce |

10  |2021 Proxy Statement |2021 Proxy Statement

| | to steward sustainability within and beyond AbbVie. On Earth Day, we launched an employee sustainability engagement campaign called EcoChallenge to encourage the adoption of sustainable behaviors at work and home. Over 48,100 sustainable actions were completed and 2,200 colleagues from 36 different countries participated. |

| o | We completed the first year of our SPARK Innovation Accelerator, an incubator for employee-driven AbbVie sustainability proposals. The estimated positive impact from the proposals is a reduction of 95,700 cubic meters of water (38 Olympic swimming pools) and a reduction of 613 metric tons of waste (307 garbage trucks). The program was highly successful prompting us to solicit proposals again for 2021. Colleagues from 37 different global sites submitted over 200 ideas for the second year of the innovation program. |

| o | We continued to make progress against our 2025 environmental targets. Since 2015, we have reduced our absolute carbon dioxide emissions (scope 1 and 2) by more than 20%, on track to meet our 2025 target of 25%. We increased the percentage of purchased electricity that is from renewable sources to more than 25%, also on track to meet our 2025 target of 50%. |

| o | At our manufacturing site in Sligo, Ireland, our on-site water treatment system has reduced 5,000 metric tons of water waste. Similarly, our new co-generation system at our manufacturing site in Barceloneta, Puerto Rico enables AbbVie’s plant to generate its own electricity and operates completely on liquified natural gas, replacing our use of #6 fuel oil, which has higher emissions. |

| o | AbbVie is actively working toward fleet sustainability through the transition of sales force vehicles to electric and hybrid vehicles, with some of our global markets already over 75% transitioned. |

| ● | Stewarding our ethical business |

| o | As part of our commitment to ethical privacy practices and compliance with global privacy laws, in 2020 we launched a global privacy awareness campaign with engaging interactive content, highlighting important privacy principles for our employees. The program reinforced the ways our employees can remain compliant with privacy requirements in their day-to-day work and emphasizes the importance of being good stewards of AbbVie’s data. |

| o | With the acquisition of Allergan in 2020, we began executing on plans to merge and harmonize the robust ethics and compliance programs of AbbVie and Allergan to best meet the needs of our business. All employees received AbbVie’s annual training on our Code of Business Conduct and updated conflicts of interest training. Employees in relevant functions also received mandatory training on topics such as anti-corruption and anti-bribery, recognizing and reporting safety information, appropriate product promotion, and appropriate interactions with health care providers and patient groups. Our compliance training is continually reviewed and updated as necessary to ensure employees are receiving the most relevant and timely information on these important topics. |

| o | Creating an environment where employees can raise questions and concerns helps us advance our commitment to ethical behavior. We have established systems and processes for all employees to ask questions and report suspected or actual violations of our Code, policies, and procedures. We offer various reporting resources to employees, such as our Ethics and Compliance Helpline (which permits reports in several different languages), a telephone and Web-based hotline available 24 hours a day, seven days a week. Employees may also contact the Office of Ethics and Compliance or Chief Ethics and Compliance Officer directly. Pursuant to our Code, AbbVie does not tolerate retaliation against anyone who makes a good faith report. |

2021 Proxy Statement Environmental Stewardship.| 11 11

AbbVie has robust, long-term targets to reduce our environmental footprint, including reducing carbon emissions by 25 percent by 2025 (over 2015 baseline). In one year, AbbVie reduced carbon emissions globally by 8 percent on an absolute basis.

•Neglected Diseases. AbbVie scientists have dedicated over 60,000 pro bono hours since the company's inception to research neglected diseases.

•Commitment to Diversity. Women comprise 53% of AbbVie's total workforce and 46% of AbbVie's management. We are recognized as a leading workplace by Working Mother Magazine's "100 Best Companies for Working Mothers" and DiversityInc's "Top 50 Companies for Diversity." In 2017, for the third consecutive year, AbbVie received a perfect score of 100% in the Corporate Equality Index administered by the Human Rights Campaign Foundation.

•Access to Medicines. In 2017, nearly 80,000 U.S. patients were provided medication at no cost through AbbVie patient assistance programs.

•Charitable Contributions. Over the past five years, we've been able to reach more than 19 million people in more than 85 countries through our charitable giving. In 2017 alone, our response to natural and humanitarian disasters led to 61 countries receiving product donations and grants from AbbVie and the AbbVie Foundation. While continuing our support of existing partners through ongoing donations, we announced in January 2018 an additional charitable contribution of approximately $350 million to select non-profit organizations. This contribution will support initiatives such as the rebuilding of homes and healthcare infrastructure in Puerto Rico, assist families with children facing a serious illness, and bolster charities that support our local community needs.

•Community Engagement. Since our launch in 2013, our employees have volunteered over 237,000 hours. We are proud of our Week of Possibilities, AbbVie's global signature volunteer annual event to benefit underserved populations in communities where AbbVie employees live and work. In 2017, more than 7,200 employees volunteered to complete hands-on service projects in 57 countries. AbbVie's corporate responsibility efforts have been consistently recognized by third parties, including: biotechexternal rankings and ratings as a leader on the Dow Jones Sustainability Index in 2016 and 2017 for our strong social, environmental, governance and business practices; score of A- in 2016 and 2017 on climate change by CDP for our disclosure and sustainability efforts; inclusion on Civic 50 for four consecutive years as one of the 50 most community-minded companies in the United States; and inclusion in FTSE4Good since 2016.

More detailscorporate responsibility. For more information about our corporate responsibility efforts, key performance indicators, and areas of importance to our stakeholders are available on our website atwww.abbvie.com/responsibility.please visit abbvie.com/responsibility.

EXTERNAL RECOGNITION | DiversityInc. Top 50 Companies for Diversity Ranked in the top 20 | | | FORTUNE 100 Best Companies to Work For Included for three consecutive years | | | Great Place to Work World’s Best Workplaces Included for four consecutive years | | | | | | | | | | | | | | | Human Rights Campaign Corporate Equality Index Scored 100% for five consecutive years | | | Working Mother 100 Best Companies Top 10 for three consecutive years | | | Dow Jones Sustainability World Index Included in the index for eight consecutive years | | | | | | | | | | | | | | | 3BL Media 100 Best Corporate Citizens Top 30 | | | EcoVadis Advanced ranking | | | PEOPLE’s 50 Companies that Care Included for two consecutive years |

612   | |20182021 Proxy Statement

Table of Contents

Executive Compensation Highlights

| | | PROXY SUMMARY |

AbbVie's board

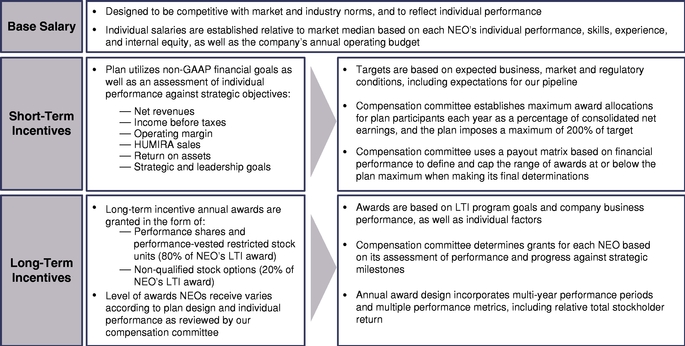

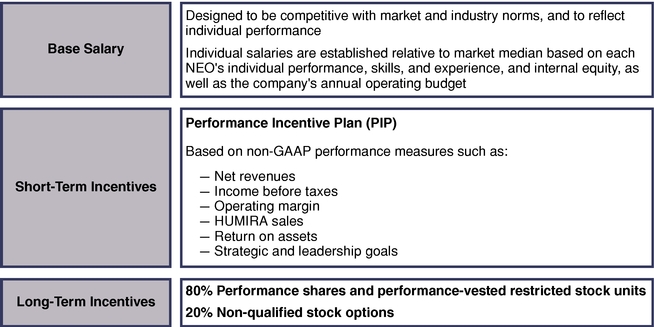

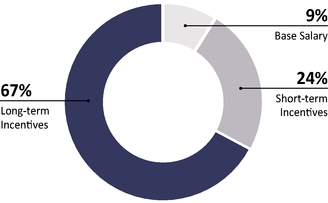

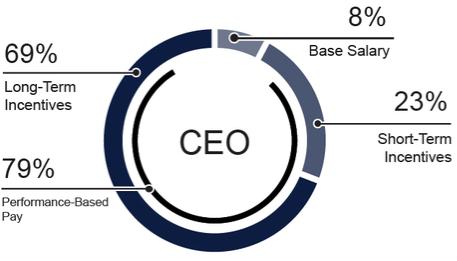

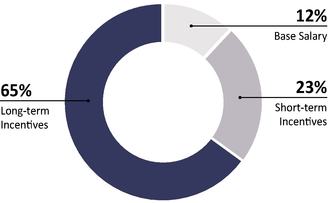

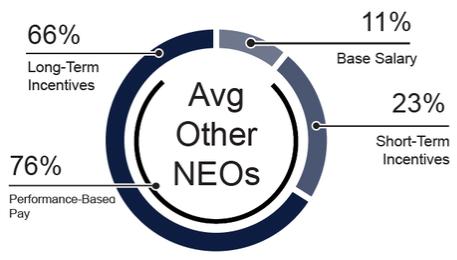

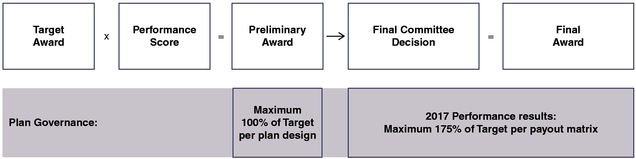

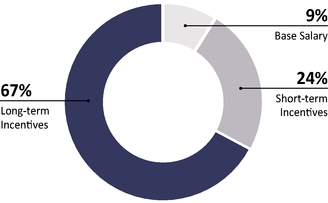

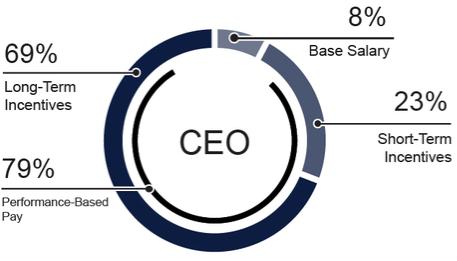

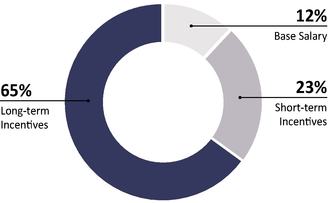

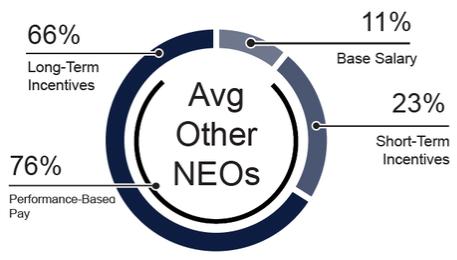

Executive Compensation Highlights | The compensation committee has designed and implemented an executive compensation program in which a substantial majority of named executive officer (NEO) compensation at AbbVie is performance-based. |

The goals of directors believes a well-designedour compensation program should align executive interests with the drivers of stockholder returns and profitable growth, support achievement of the company's primary business goals, and attract and retain world-class executives whose talents and contributions sustain the growth in long-term stockholder value. Consequently, the compensation committee of the board has designed and implemented an executive compensation program in which a substantial majority of named executive officer (NEO) compensation at AbbVie is performance-based.are to: | | | | | | | | 1 | Align executive interests with the drivers of stockholder returns and profitable growth | | 2 | Support achievement of the company’s primary business goals to have a remarkable impact on patients’ lives | | 3 | Attract and retain world-class executives whose talents and contributions sustain the growth in long-term stockholder value |

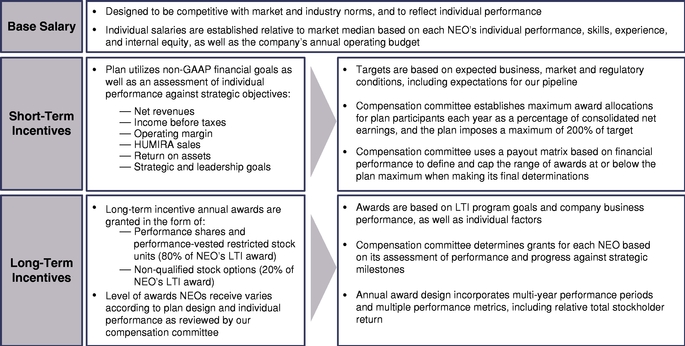

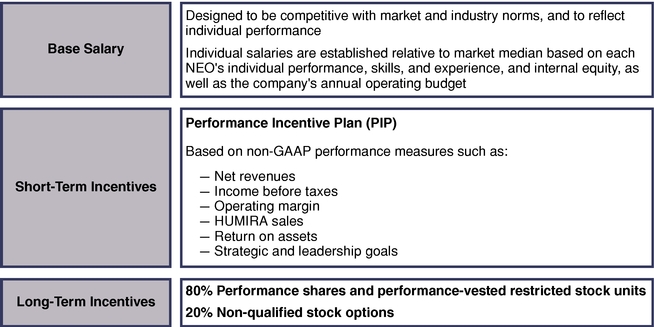

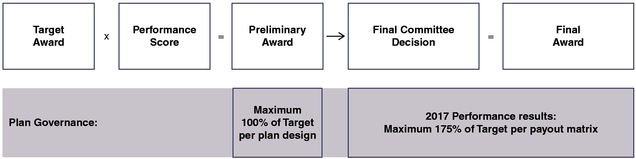

When determining NEO compensation, the committee first considers the median of the competitive marketplace (as derived primarily from the Health Care Peer Group approved by the committee) as an initial benchmark for assessing compensation. The committee then takes into account the company'scompany’s overall performance against the financial, operating and strategic objectives that were established at the start of the performance period. Finally, specific pay determinations are made for each NEO based on his or her individual performance against goals and contributions to the short- and long-term performance of the company. Key components and design of our executive compensation program: Three primary components make up AbbVie'sAbbVie’s executive pay program: base salary, short-term incentives, and long-term incentives. The structure of each component is tailored to serve a specific function and purpose. The following is a summary of the key components of our compensation program. | | | | | | | | | | Element | | Type | | Primary

Objective | | Key Characteristics | | | | | | | | | | | | Base Salary | | Fixed | | Attract & retain top talent | | Individual salaries are established relative to market median based on each NEO’s individual performance, skills, experience, and internal equity, as well as the company’s annual operating budget | | | | | | | | | | | | Short-Term Incentives | | At-Risk | | Encourage achievement of company’s primary business goals | | Plan utilizes non-GAAP financial goals as well as an assessment of individual performance against strategic objectives: — Net revenues — Income before taxes — Operating margin — Return on assets — Strategic and leadership goals | | | | | | | | | | | | Long-Term Incentives | | At-Risk | | Align NEO interests with stockholders | | Long-term incentive annual awards are granted in the form of: — Performance shares and performance vested restricted stock units (80% of NEO’s LTI award) — Non-qualified stock options (20% of NEO’s LTI award) | | | | | | | | | | |

20182021 Proxy Statement |  7 13

Who Can Vote

Stockholders of record at the close of business on March 7, 2018 will be entitled to notice of and to vote at the Annual Meeting. As of March 7, 2018, AbbVie had [ ] outstanding shares of common stock, which are AbbVie's only outstanding voting securities. Each stockholder has one vote per share. Stockholders do not have the right to vote cumulatively in electing directors.

Notice and Access

In accordance with the Securities and Exchange Commission (SEC) e-proxy rules, AbbVie mailed a Notice of Internet Availability of Proxy Materials (the "Notice") to stockholders in March 2018. The Notice describes the matters to be considered at the Annual Meeting and how stockholders can access the proxy materials online. It also provides instructions on how stockholders can vote their shares. If you received the Notice, you will not receive a printed version of the proxy materials unless you request one. If you would like to receive a printed version of the proxy materials, free of charge, please follow the instructions on the Notice.

Voting by Proxy

AbbVie's stockholders may vote their shares by telephone, the Internet, or at the Annual Meeting. If you vote by telephone or the Internet, you do not need to return your proxy card. The instructions for voting can be found on the Notice, on the website listed in the Notice, and, if you received one, on your proxy card. If you requested a printed version of the proxy card, you may also vote by mail.

Revoking a Proxy

You may revoke your proxy by voting in person at the Annual Meeting or, at any time prior to the meeting:

•by delivering a written notice to the secretary of AbbVie,

•by delivering an authorized proxy with a later date, or

•by voting by telephone or the Internet after you have given your proxy.

Discretionary Voting Authority

Unless otherwise specified in accordance with the instructions on the proxy, the persons named in the proxy will vote the shares of AbbVie common stock covered by proxies they receive to elect the four nominees named in Item 1 on the proxy card. If a nominee becomes unavailable to serve, the shares will be voted for a substitute designated by the board of directors or for fewer than four nominees if, in the judgment of the proxy holders, such action is necessary or desirable.

Where a stockholder has specified a choice for or against the proposals to be presented at the Annual Meeting or if the stockholder has chosen to abstain, the shares of AbbVie common stock represented by the proxy will be voted (or not voted) as specified. Where no choice has been specified, the proxy will be voted FOR the ratification of Ernst & Young LLP as auditors, FOR the approval of executive compensation, FOR management's recommendation to hold a vote to approve executive compensation annually, FOR the management proposal regarding the annual election of directors, FOR the management proposal to eliminate supermajority voting, and AGAINST each of the stockholder proposals.

The board of directors is not aware of any other issue that may properly be brought before the meeting. If other matters are properly brought before the meeting, the accompanying proxy will be voted in accordance with the judgment of the proxy holders.

8  |2018 Proxy Statement

Table of Contents

| | What am I voting on and how should I vote? | You are being asked to elect four Class III directors at the Annual Meeting. INFORMATION ABOUT THE ANNUAL MEETINGThe board of directors therefore recommends you vote “FOR” each of the nominees set forth below.

|

Quorum and Vote Required to Approve Each Item on the Proxy

A majority of the outstanding shares entitled to vote generally in the election of directors, represented in person or by proxy, constitutes a quorum. Directors are elected by stockholders in an uncontested election if a majority of the votes cast are "for" a director's re-election at the Annual Meeting, excluding abstentions and broker non-votes. For other matters, the affirmative vote of a majority of the shares represented, in person or by proxy, at the meeting and entitled to vote on a matter shall be the act of the stockholders with respect to that matter; except for the management proposal regarding the annual election of directors, and the management proposal to eliminate supermajority voting, each of which require the affirmative vote of shares representing not less than eighty percent (80%) of the outstanding shares of capital stock of AbbVie entitled to vote generally in the election of directors pursuant to Article XI of AbbVie's Amended and Restated Certificate of Incorporation.

Effect of Broker Non-Votes and Abstentions

A proxy submitted by an institution such as a broker or bank that holds shares for the account of a beneficial owner may indicate that all or a portion of the shares represented by that proxy are not being voted with respect to a particular matter. This could occur, for example, when the broker or bank is not permitted to vote those shares in the absence of instructions from the beneficial owner of the stock. These "non-voted shares" will be considered shares not present and, therefore, not entitled to vote on those matters, although these shares may be considered present and entitled to vote for other purposes. Brokers and banks have discretionary authority to vote shares in the absence of instructions on matters the New York Stock Exchange considers "routine," such as the ratification of the appointment of the auditors. They do not have discretionary authority to vote shares in absence of instructions on "non-routine" matters. The election of directors, the advisory vote on the approval of executive compensation, the advisory vote on the frequency of votes to approve executive compensation, the management proposal regarding the annual election of directors, the management proposal to eliminate supermajority voting, and the stockholder proposals are considered "non-routine" matters. Non-voted shares will not affect the determination of the outcome of the vote on any matter to be decided at the meeting. Shares represented by proxies that are present and entitled to vote on a matter but that have elected to abstain from voting on that matter, other than the election of directors, will have the effect of votes against that matter.

Inspectors of Election

The inspectors of election and the tabulators of all proxies, ballots, and voting tabulations that identify stockholders are independent and are not AbbVie employees.

Cost of Soliciting Proxies

AbbVie will bear the cost of making solicitations from its stockholders and will reimburse banks and brokerage firms for out-of-pocket expenses incurred in connection with this solicitation. Proxies may be solicited by mail, telephone, Internet, or in person by directors, officers, or employees of AbbVie and its subsidiaries.

AbbVie has retained Georgeson Inc. to aid in the solicitation of proxies, at an estimated cost of $19,500 plus reimbursement for reasonable out-of-pocket expenses.

AbbVie Savings Plan

Participants in the AbbVie Savings Plan will receive voting instructions for their shares of AbbVie common stock held in the AbbVie Savings Plan Trust. The Trust is administered by both a trustee and an investment committee. The trustee is The Northern Trust Company. The members of the investment committee are William H.S. Preece, Tabetha A. Skarbek and Michael J. Thomas, employees of AbbVie. The voting power with respect to the shares is held by and shared between the investment committee and the participants. The investment committee must solicit voting instructions from the participants and follow the voting instructions it receives. The investment committee may use its own discretion with respect to those shares of AbbVie common stock for which no voting instructions are received.

2018 Proxy Statement | 9

Table of Contents

The board of directors consists of three classes currently comprised of threefour directors in Class I, four directors in Class II, and four directors or director nominees in Classes II andClass III. Directors of one class are elected each year for a term of three years. The Class III directors are presented for re-election to hold office until the expiration of their term at the 20212024 annual meeting of stockholders and until their successors are elected and qualified or until their earlier death or resignation. All of the nominees are currently serving as directors. Directors are elected by stockholders if a majority of the votes cast are "for"“for” a director'sdirector’s re-election at the Annual Meeting, excluding abstentions and broker non-votes. For more information on the director majority vote standard, see AbbVie'sAbbVie’s By-Laws as listed as an exhibit to AbbVie's 2017AbbVie’s 2020 Annual Report on Form 10-K. All 14 |2021 Proxy Statement |2021 Proxy Statement

Nominees (Class III) Class III—Directors Whose Terms Expire in 2018

|

| | |

Committees:

Audit Compensation

Director since: 2013

Age: 57

| |

Roxanne S. Austin Director Since: 2013 Age: 60 Committees: Audit and Compensation Primary Occupation: President, Austin Investment Advisors

| | | Business Experience: Ms. Austin is president of Austin Investment Advisors, a private investment and consulting firm, and chairs the U.S. Mid-market Investment Advisory Committee of EQT Partners. Previously, Ms. Austin also served as the president and chief executive officer of Move Networks, Inc., a provider of Internet television services. Ms. Austin served as president and chief operating officer of DIRECTV, Inc. Ms. Austin also served as executive vice president and chief financial officer of Hughes Electronics Corporation and as a partner of Deloitte & Touche LLP. Ms. Austin is also a director of Abbott Laboratories, Target Corporation, andCrowdstrike, Inc., Teledyne Technologies, Inc., and Verizon Communications Inc. Ms. Austin has notified Teledyne of her intent to resign from its Board of Directors at the company’s next annual meeting of stockholders, currently planned for April 2021. Ms. Austin also served as a director of Telefonaktiebolaget LM Ericsson from 2008 to 2016. | | Key Contributions to the Board: | ·Through her extensive management and operating roles, including her financial roles, Ms. Austin contributes significant oversight and leadership experience to the board, including financial expertise and knowledge of financial statements, corporate finance, and accounting matters. |

10  |2018 Proxy Statement

Table of Contents

INFORMATION CONCERNING DIRECTOR NOMINEES |

| | |

Director since: 2013

Age: 64

|

|

Richard A. Gonzalez Director Since: 2013 Age: 67 Primary Occupation: Chairman of the Board and Chief Executive Officer, AbbVie Inc.

Inc. | | | Business Experience: Mr. Gonzalez is the chairman and chief executive officer of AbbVie. He served as Abbott'sAbbott’s executive vice president of the pharmaceutical products group from July 2010 to December 2012, and was responsible for Abbott'sAbbott’s worldwide pharmaceutical business, including commercial operations, research and development, and manufacturing. He also served as president, Abbott Ventures Inc., Abbott'sAbbott’s medical technology investment arm, from 2009 to 2011. Mr. Gonzalez joined Abbott in 1977 and held various management positions before briefly retiring in 2007, including: Abbott'sAbbott’s president and chief operating officer; president, chief operating officer of Abbott'sAbbott’s Medical Products Group; senior vice president and president of Abbott'sAbbott’s former Hospital Products Division; vice president and president of Abbott'sAbbott’s Health Systems Division; and divisional vice president and general manager for Abbott'sAbbott’s Diagnostics Operations in the United States and Canada. | | Key Contributions to the Board: | ·As a result of his service as Abbott'sAbbott’s executive vice president, Pharmaceutical Products Group, his previous service as Abbott'sAbbott’s president and chief operating officer and his more than 30-year career at Abbott, Mr. Gonzalez has developed valuable business, management, and leadership experience, as well as extensive knowledge of AbbVie and its global operations. ·Mr. Gonzalez'sGonzalez’s experience and knowledge enable him to contribute to AbbVie'sAbbVie’s board key insights into strategic, management, and operational matters. |

2021 Proxy Statement | 15 15

|

Rebecca B. Roberts Director Since: 2018 Age: 68 Committees: Nominations & Governance and Public Policy Primary Occupation: Retired President of Chevron Pipe Line Company

| | | Business Experience: Ms. Roberts served as president of Chevron Pipe Line Company from 2006 until her retirement in 2011. She previously served as the president of Chevron Global Power Generation from 2003 to 2006, in addition to various technical and management positions during her thirty-six year career with Chevron. Ms. Roberts began her career as a chemist and research scientist. Ms. Roberts currently serves on the board of directors at Black Hills Corporation Enbridge, Inc., and MSA Safety Incorporated. Ms. Roberts served as a director of Enbridge, Inc. from 2015 to 2018. | | Key Contributions to the Board: | ·Ms. Roberts brings management, operational, safety, and strategy development expertise with a scientific background and extensive global experience at Chevron. ·She provides an informed perspective to the board on regulatory and operational matters faced by a complex international company. |

2018 Proxy Statement | 11

Table of Contents

INFORMATION CONCERNING DIRECTOR NOMINEES

|

| | |

Director Since: 2013 Age: 72 Committees:

Audit, Compensation,

Nominations & Governance, and Public Policy Lead Independent Director

Primary Occupation: Director since: 2013

Age: 69 |

|

Glenn F. TiltonRetired Chairman and Chief Executive Officer of the UAL Corporation

Lead Independent Director | | | Business Experience: Mr. Tilton was chairman of the Midwest for JPMorgan Chase & Co. from 2011 until his retirement in 2014. From October 2010 to December 2012, Mr. Tilton also served as the non-executive chairman of the board of United Continental Holdings, Inc. From September 2002 to October 2010, he served as chairman, president and chief executive officer of UAL Corporation, and chairman and chief executive officer of United Air Lines, Inc., its wholly owned subsidiary. Prior to becoming the vice chairman of Chevron Texaco following the merger of Texaco Inc. and Chevron Corp., Mr. Tilton enjoyed a 30-year multi-disciplinary career with Texaco Inc., culminating in his election as chairman and chief executive officer. Mr. Tilton is also a director of Abbott Laboratories and Phillips 66. Mr. Tilton also served on the board of directors of Lincoln National Corporation from 2002 to 2007, of TXU Corporation from 2005 to 2007, of Corning Incorporated from 2010 to 2012, and of United Continental Holdings, Inc. from 2010 to 2012. | | Key Contributions to the Board: | ·As chairman of the Midwest for JPMorgan Chase & Co. and having previously served as non-executive chairman of the board of United Continental Holdings, Inc., and chairman, president, and chief executive officer of UAL Corporation and United Air Lines, vice chairman of Chevron Texaco and as interim chairman of Dynegy, Inc., Mr. Tilton acquired strong management experience overseeing complex multinational businesses operating in highly regulated industries, as well as expertise in finance and capital markets matters. ·His experience as non-executive chairman of the board of United Continental Holdings, Inc. also enhances his contributions as AbbVie'sAbbVie’s lead independent director. |

16  |2021 Proxy Statement |2021 Proxy Statement

Class I – Directors whose terms expire in 2022 Class I—Directors Whose Terms Expire in 2019

|

| | |

Committees:

Audit

Nominations &

Governance

Director since: 2013

Age: 66

| |

William H.L. Burnside Director Since: 2013 Age: 69 Committees: Audit and Nominations & Governance Primary Occupation: Retired Senior Vice President and Director at The Boston Consulting Group

| | | Business Experience: Mr. Burnside is a retired senior vice president and director at The Boston Consulting Group (BCG), where he currently serves as an advisor. Prior to becoming managing partner of BCG'sBCG’s Los Angeles office in 1987, he worked in BCG'sBCG’s London and Chicago offices, servicing clients in telecommunications, media, defense, financial services, and manufacturing. Mr. Burnside is a director at Audubon California. | | Key Contributions to the Board: | ●Through his experience with The Boston Consulting Group, Mr. Burnside contributes knowledge and understanding of corporate finance and capital markets matters to the board, as well as global and domestic strategic advisory experience across a broad base of industries. |

| 2016 50 Executive Vice President and Chief Administrative Officer, United Airlines Holdings, Inc. |

| Thomas C. Freyman Director Since: 2020 Age: 66 Committees: Compensation Primary Occupation: Retired Executive Vice President, Finance and Administration, Abbott Laboratories | | | Business Experience: Mr. Freyman served as a director at Allergan from 2018 to 2020, when AbbVie acquired Allergan plc. Mr. Freyman previously served as executive vice president, finance and administration at Abbott Laboratories from 2015 until his retirement in 2017. He previously served at Abbott as chief financial officer and executive vice president, finance and was first appointed chief financial officer and senior vice president, finance in 2001. He also serves as a director of Tenneco Inc. and Hanger, Inc. | | Key Contributions to the Board: | ·Mr. Freyman’s extensive experience as a leader in the healthcare industry, knowledge of the Allergan businesses, and expertise in complex accounting and financial issues provides the board with significant global industry experience, continuity in oversight of the Allergan businesses, and finance and risk expertise. |

2021 Proxy Statement 12  | 2018 Proxy Statement17

Table of Contents | | INFORMATION CONCERNING DIRECTOR NOMINEES | |